Mobile Homes with Land for Sale: A Practical Buyer’s Guide

Introduction and Outline

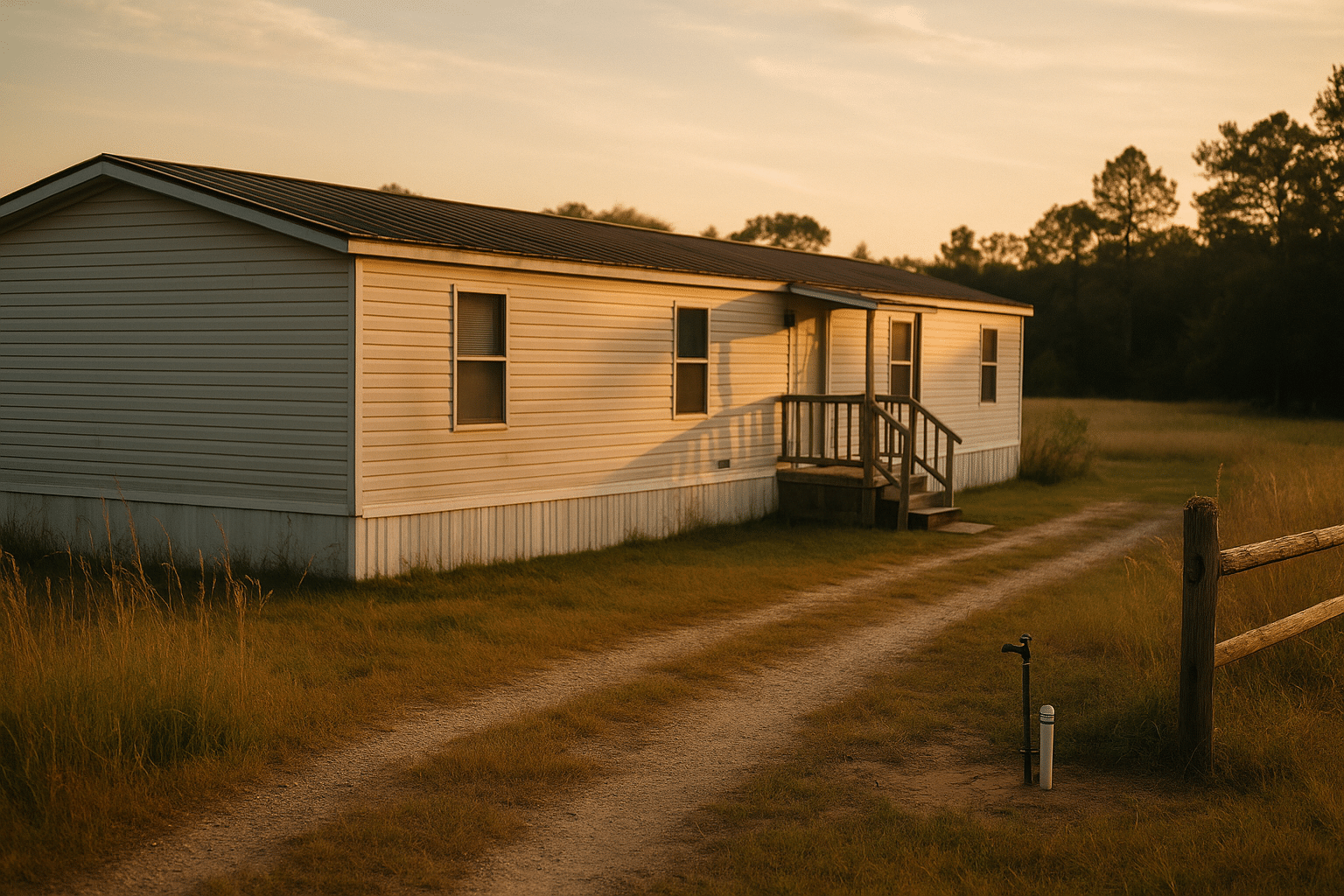

Owning a mobile home with land is a down‑to‑earth path to space, privacy, and equity without committing to a sprawling mortgage or dense subdivision life. For many buyers, the appeal is simple: you gain a home and the dirt beneath it, avoid monthly lot rent, and earn the freedom to landscape, garden, or add a workshop—subject to local rules. Demand has grown as remote and hybrid work broaden the map of “commutable,” while the cost of conventional site‑built homes has pushed households to consider more flexible options. Manufactured housing serves millions nationwide, and when paired with fee‑simple land, it can offer stability similar to a traditional house at a generally lower entry price. Yet the details matter: land use rules, foundation type, utilities, and financing can make or break the value proposition.

Before diving in, here is a clear outline so you can scan, plan, and skip straight to what you need:

– Section 1 sets the stage and shows why land‑home setups can be a practical route to ownership.

– Section 2 explains property types, land characteristics, foundations, and utility readiness that influence value and livability.

– Section 3 breaks down costs and financing, from purchase price and site work to taxes, insurance, and long‑term value.

– Section 4 covers due diligence: inspections, permits, surveys, title work, and hazard checks that reduce surprises.

– Section 5 guides your search, negotiation, and closing—and finishes with a concise conclusion tailored to first‑time and move‑up buyers.

Use this outline like a map. If your priority is understanding whether an older unit qualifies as real property, jump to the foundation and title discussion. If you’re budgeting a rural build with a well and septic, the cost section will help you frame realistic ranges. And if you are moments from making an offer, the due‑diligence checklist and closing steps can keep your momentum sharp while protecting your wallet.

Property Types, Land, Foundations, and Utility Readiness

Not all factory‑built homes are alike, and lenders, appraisers, and counties treat them differently. A “mobile home” commonly refers to units built before a nationwide manufactured‑home construction standard took effect in the mid‑1970s. “Manufactured homes” are built to that federal standard and carry a certification label, while “modular homes” are factory‑built but assembled on site as real property under local building codes. Why it matters: classification affects financing options, insurance, taxes, and whether the home can be titled as real estate alongside the land.

Foundation and title status often determine whether your home is considered real property. Many jurisdictions require a permanent foundation, compliant anchoring, and a formal process to retire the home’s vehicle‑style title so it merges with the land deed. If the unit still has axles, a tongue, or non‑permanent blocking, plan on additional work and inspections to meet local standards. A permanently affixed manufactured home on fee‑simple land can be appraised and financed more like a site‑built house, whereas a home treated as personal property may require a different loan type with distinct terms.

Choosing land is more than acreage. Flat, well‑draining sites shorten build timelines and reduce foundation costs; steep or rocky parcels can raise excavation and anchoring expenses. Zoning and land‑use classifications control whether a manufactured home is allowed at all, and some areas set minimum lot sizes or require specific design features, skirting, or roof pitches. Confirm setbacks, road access, and any private covenants that restrict additions such as garages, sheds, or second dwellings.

Utility readiness can shift the budget dramatically. Public water and sewer offer simplicity but may require connection fees or line extensions. Rural parcels often depend on a private well and septic system; in many counties, a soil and percolation test is a prerequisite to permit a septic tank and drain field. Power service may need a new pole or trenching from the nearest transformer; internet may require fixed‑wireless or satellite. Before making an offer, map each utility path to time, cost, and risk:

– Water: existing meter or well depth/flow; water quality tests for minerals and contaminants

– Sewer/Septic: percolation results, tank capacity, and location suitable for future repairs

– Electric: distance to service, amperage needed, panel age and clearances

– Gas/Propane: line availability or tank placement, ventilation, and pad requirements

– Data: cellular strength, line‑of‑sight for fixed wireless, or conduit for future fiber

A thoughtfully chosen parcel, matched with the right home type and a bona fide permanent foundation, turns a manufactured home into a stable, financeable, and comfortable long‑term residence.

Costs, Financing, and Long‑Term Value

Successful purchases start with a complete budget that goes beyond the sticker price. Total cost blends land value, the home itself, site work, and ongoing ownership expenses. Local markets vary widely, but you can build a reliable framework using the categories below and then plug in quotes from local contractors and officials.

– Acquisition: negotiated price for land plus home (or land only, if you will place a new unit later)

– Site work: clearing, grading, driveway base, drainage, and foundation or pier system

– Utilities: well drilling and pump; septic tank and drain field; water/sewer tap fees; electrical trenching and meter

– Compliance: permits, impact fees, surveys, and any required engineering letters or foundation certifications

– Move‑in: skirting, steps or porches, HVAC setup, appliances, outbuildings, and basic landscaping

– Ongoing: property taxes, homeowners insurance, hazard coverage, routine maintenance, and reserves for roof, siding, and systems

Financing depends on how the property is classified. When a manufactured home is permanently affixed and legally converted to real property with the land, conventional mortgages and certain government‑backed products may be available, often with longer terms and comparatively lower rates than loans secured only by the home itself. Homes treated as personal property typically fall under installment or chattel‑style loans, which may feature shorter terms and higher interest rates. Down payments can range from low single digits to 20% or more, depending on credit profile, property type, and lender requirements. Appraisals look for comparable sales of similar land‑home packages nearby; scarcity of comps can affect valuations, so consider neighborhoods where manufactured homes on land are common enough to support reliable pricing.

Long‑term value aligns closely with land quality, location, and the permanence of the installation. Historically, manufactured homes in land‑lease parks may depreciate like vehicles, while those on owned land with a permanent foundation can behave more like conventional housing, especially in areas with limited supply and strong demand. Resale value is influenced by age and condition (roofing, siding, underbelly insulation), energy performance, and curb appeal. On the expense side, property taxes for a land‑home package are typically assessed like other residential property in the jurisdiction; insurance may include wind, flood, or wildfire riders based on local risk maps.

To avoid budget drift, request itemized quotes for utilities and foundation work before you commit, confirm permit fees with the county, and build a contingency reserve. A clear, written financial plan will keep your purchase resilient in the face of supply and scheduling surprises.

Due Diligence: Inspections, Permits, Surveys, and Risk Checks

Professional due diligence transforms a promising listing into a confident purchase. Begin with the home’s identity: locate the manufacturer data plate and serial details inside a cabinet or closet, note the year built, and confirm compliance with the federal manufactured‑home construction standard. Ask for any installation records or engineering letters that document the foundation system and tie‑downs. If the home is older, verify whether significant updates have been made to roofing, windows, insulation, plumbing, and electrical components.

A comprehensive inspection should include the crawl space or undercarriage (piers, footings, vapor barrier), skirting integrity, evidence of moisture, and proper anchoring. Roof condition matters: look for granular loss, soft decking, ponding, or past patchwork; on pitched roofs, check flashing around penetrations and the slope’s ability to shed water. Inside, evaluate floor rigidity (especially near bathrooms and kitchens), signs of leaks, GFCI protection in wet areas, and HVAC age and service history. Exterior additions—porches, decks, carports—should be independently supported rather than attached in a way that stresses the home’s structure.

Land checks protect your use and resale potential. Order a boundary survey to identify encroachments, easements, and right‑of‑way access; compare the survey to the legal description on the deed. Confirm zoning allows manufactured housing and that setbacks, height limits, and lot coverage rules are met by the existing placement. If the property is served by a septic system, request pumping and an inspection with a capacity and condition report; for wells, ask for flow testing and a water quality panel. Review flood maps and wildfire or wind‑exposure maps to understand insurance implications and mitigation steps.

Paperwork rounds out the safety net. A title search should verify the seller’s right to convey both land and home, reveal liens, and confirm whether any vehicle‑style titles have been retired. Check permit history to ensure that major work—such as installation, foundation upgrades, electrical service, or additions—was properly permitted and inspected. If the home is in a private community, read covenants and rules for restrictions on parking, fencing, exterior changes, or future additions.

Finally, align all findings in a single report you can use to negotiate. Defects with clear costs—failing skirting, outdated tie‑downs, undersized electrical service, compromised roof—are natural candidates for credits or repairs prior to closing. The goal is not perfection, but clarity: you want a property whose risks are known, priced in, and manageable.

Search, Negotiation, Closing, and a Practical Conclusion

Effective searches combine local knowledge with disciplined filters. Start by targeting counties and neighborhoods where manufactured homes on owned land are common; this improves the odds of finding comparable sales and realistic pricing. Spot early indicators of quality: paved road access, visible permanent foundations, thoughtful grading and drainage, and documented utility connections. When touring, bring a checklist so you can compare apples to apples across properties:

– Land: slope, soil, drainage, driveway access, and space for future additions

– Utilities: type, age, and condition; true costs to upgrade service or replace systems

– Structure: foundation certification, anchoring, roof age, and underfloor condition

– Setting: noise, odors, agricultural activity, seasonal traffic, and emergency access

Negotiation hinges on data. Pair your inspection results with contractor quotes to justify price adjustments or credits. If the home’s title has not been merged with the land, request that the seller complete the conversion or price the work into your offer. Consider protective contingencies—financing, appraisal, inspections, and permit approvals—as timing tools rather than blunt instruments; set clear deadlines, communicate proactively, and be prepared to extend only when new facts justify it. If competition is stiff, clean up the offer by tightening timelines and providing earnest money, while still preserving key protections.

Closing requires coordination. Your closing agent or attorney will balance the title work, lien releases, surveys, and recording of documents. Confirm that any required foundation letters, installation records, and permits are in the closing package, and that the property’s legal description matches your survey. Arrange final utility transfers and insurance coverage to begin at closing, and schedule a last‑minute walk‑through to verify agreed repairs and property condition.

Conclusion: A manufactured home on owned land can be a versatile, attainable form of homeownership when you respect the details—classification, foundations, utilities, and local rules. Approach the purchase like a project manager: define scope, price the work, verify compliance, and build contingencies. With a sound parcel, a permanent installation, and well‑documented systems, you position yourself for comfortable living and future resale flexibility. Take your time, ask precise questions, and let the facts guide a confident, value‑savvy decision.