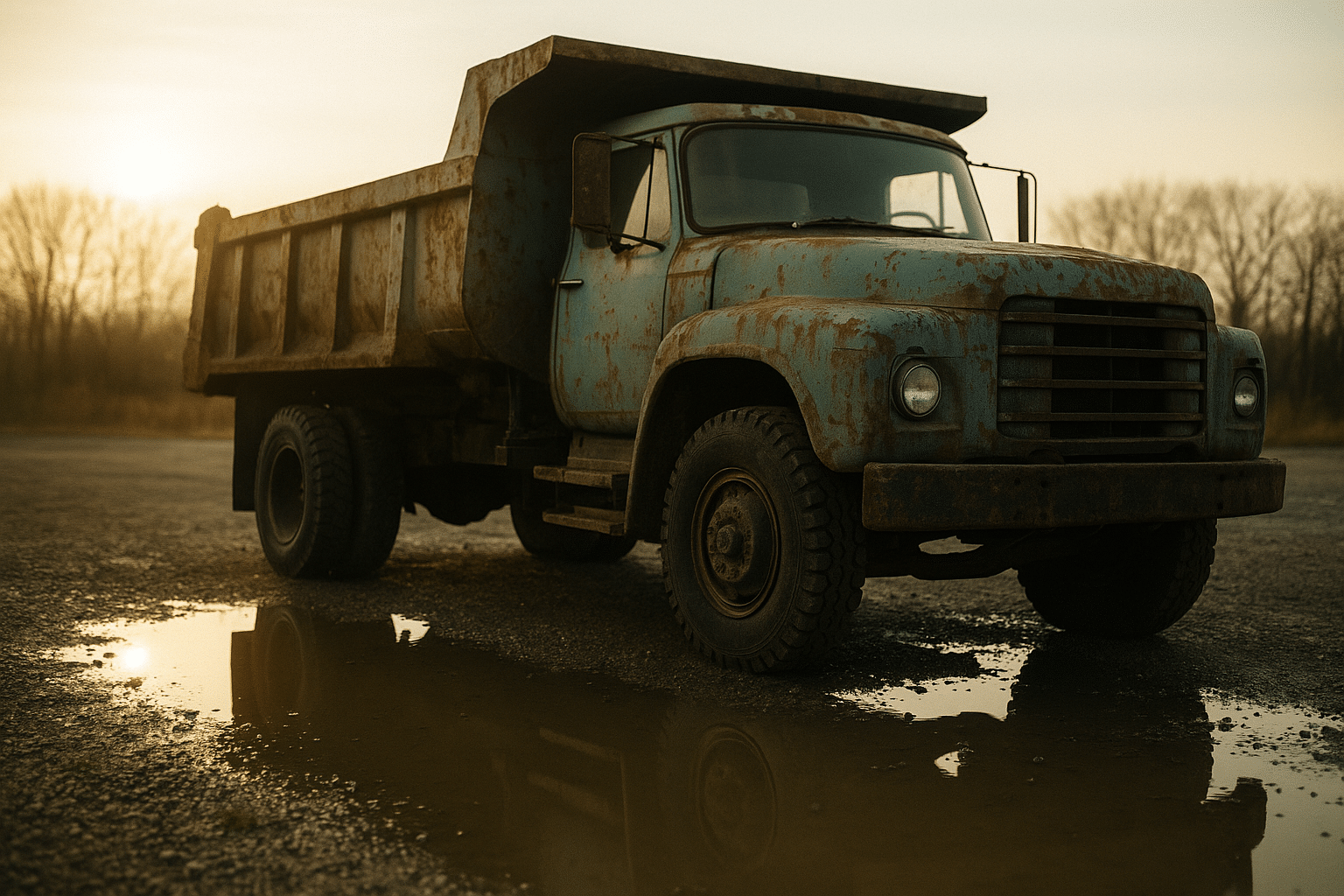

What to Know About Bank-Repossessed Dump Truck Costs and Key Considerations

Outline:

– Pricing landscape and market drivers

– Total cost of ownership and inspection priorities

– Auction mechanics and acquisition channels

– Financing, insurance, and legal safeguards

– Negotiation tactics, red flags, and practical scenarios

The Pricing Landscape: What Bank Repos Really Cost

Bank‑repossessed dump trucks can offer meaningful savings versus traditional used listings, but the price you see is only one variable in a dense market equation. In many regions, late‑model medium‑duty units with moderate hours can land in the approximate range of 10–25% below comparable dealer‑retail prices, while high‑mileage heavy tri‑axle rigs might close the gap to nearer 5–15% depending on condition, season, and buyer competition. Entry points for older, work‑ready dumps sometimes appear around the cost of a new pickup, while clean, specialty configurations (steel bodies with high tensile rating, high‑lift gates, or integrated tarping systems) can command closer to retail even at auction. The key is understanding the forces behind those numbers before you bid or sign.

Supply and timing matter. When economic pressure increases defaults, inventory pools swell and pricing softens, especially for common configurations. Conversely, during peak construction cycles or regional infrastructure pushes, demand for reliable haulers tightens spreads and pushes repo prices upward. Geography also plays a role: northern units may show seasonal corrosion, pressuring price, while southern trucks might present cleaner frames but higher cooling system and air conditioning wear. Powertrain emissions requirements vary by jurisdiction, influencing demand for specific model years and aftertreatment systems.

Think in tiers rather than absolutes. A rough working framework used by many buyers looks like this:

– Older Class 6–7 chassis with basic steel body: priced to move, but expect immediate maintenance and cosmetic work.

– Mid‑cycle trucks (not new, not end‑of‑life) with documented service: often the sweet spot for value if inspections check out.

– Heavy tri‑axle or quad setups with strong components: attract more bidders; discounts tighten but uptime can offset the premium.

Finally, embed buyer’s premium, sales tax, transport, and immediate fixes into your mental “out‑the‑gate” figure. A truck that hammers at a seemingly attractive price can become average—or expensive—once the ledger includes fees (often 5–13%), towing or permits, new rubber, and deferred maintenance. The lesson: price the whole picture, not just the hammer drop or asking tag.

Total Cost of Ownership: Inspections, Repairs, and the Real All‑In Number

Total cost of ownership starts the moment you spot the listing, not after you win it. A detailed inspection plan can shift your bid by five figures, because small components on heavy equipment are seldom cheap. Begin with structural health: look for frame straightness, cross‑member corrosion, body hinge wear, and evidence of prior repairs. The dump body tells a story—dents and ripples suggest hard impacts; deep abrasion indicates frequent hauling of rock; patched floors can be workable if the welds are clean and the plate gauge is adequate. Hydraulic systems demand attention: check cylinder chrome for pitting, rod seals for weeping, pump sounds under load, and valve block leaks.

Powertrain due diligence is non‑negotiable. Cold starts should be quick and even, with stable idle and minimal white or blue smoke. Scan for aftertreatment lights and forced‑regeneration histories if accessible; particulate filter service can range from a few hundred for cleaning to several thousand for replacement. Turbo noise, excessive blow‑by, and coolant-in-oil or oil-in-coolant are immediate caution flags. Transmissions should shift cleanly without harsh clunks; automated manuals often need calibration, while conventional manuals reveal clutch wear via take‑off chatter and pedal feel.

Consumables and safety items add up quickly:

– Tires: $400–$1,200 per corner depending on size and ply; eight to ten positions get expensive fast.

– Brakes and drums: $1,200–$3,000 for a full axle set depending on parts and labor.

– Suspension components (bushings, springs, torque rods): $500–$2,500.

– Hydraulic hose refresh: $300–$1,500 depending on length and fittings.

Electrical gremlins are common on repos due to low‑use periods. Inspect harnesses for chafe points, test lighting circuits, and confirm PTO interlocks. Corrosion at ground points and battery trays can cause intermittent faults that eat shop hours. Cab condition affects driver fatigue: seat rails, HVAC performance, window regulators, and door seals all matter in daily operation.

To reach a realistic all‑in number, model three bands of spend: immediate (safety and legal roadworthiness), near‑term (reliability improvements within 60–90 days), and elective (productivity upgrades like body liners or onboard scales). Add buyer’s premium, tax, title, transport, and a contingency of 5–10% for surprises. This disciplined approach converts a tempting price into a practical ownership plan that protects uptime and cash flow.

How Repos Are Sold: Auction Dynamics, Private Sales, and Hidden Fees

Bank‑owned dumps reach buyers through several channels: timed online auctions, live regional auctions, sealed bids, and direct remarketing with a fixed asking price. Each path carries different levels of transparency and risk. Public auctions tend to maximize audience and liquidity, but they also compress inspection windows and enforce strict “as‑is, where‑is” terms. Sealed bids can favor diligent researchers who spot undervalued assets, while direct sales may allow for pre‑purchase inspections and a modest negotiation window. Regardless of channel, success comes from rules literacy and disciplined execution.

Know the fine print before you fall in love with the iron. Many platforms charge a buyer’s premium—commonly somewhere around 5–13%—plus document fees. Storage fees can accrue if pickup deadlines are missed. Some sellers require cashier’s funds within 24–72 hours and restrict test drives to yard movement only, which means your inspection must be thorough and conservative. Transportation planning is part of the bid: calculate permits for over‑dimension or overweight routing, short‑haul towing if the truck is non‑operational, and fuel or day permits for temporary moves.

Inspection access varies by channel:

– Onsite previews: bring a flashlight, creeper, paint thickness gauge, infrared thermometer, and a notepad for serials and hour meters.

– Remote purchases: request detailed photos (frame, spring hangers, bed floor, PTO, cylinder bases), fluid samples if allowed, and cold‑start videos.

– Yard starts only: listen for knocks at low RPM, observe smoke quality, confirm charging voltage, and cycle the hoist under load if permitted.

Bidding psychology is its own terrain. “Closing rush” spikes are common in online events; plan your maximum and let software place increments so emotion doesn’t rule the day. For live sales, set a walk‑away number and stick to it. If you can’t physically inspect, lower your ceiling price to absorb uncertainty. The right mindset prevents a discount asset from becoming a premium mistake.

Financing, Insurance, Titles, and Legal Safeguards You Shouldn’t Skip

Even when buying at a discount, many contractors finance part of a repo acquisition to preserve working capital. Terms depend on credit profile, time in business, collateral quality, and truck age. Expect lenders to favor newer chassis with documented maintenance and clean titles; older equipment may require higher down payments or shorter terms. Some buyers use equipment lines of credit or asset‑based facilities to move quickly at auctions. Whatever the path, build payments into your total cost per hour or per load so the math aligns with your backlog and margins.

Insurance should be quoted before you bid. At minimum, you’ll consider liability and physical damage; many fleets add roadside assistance and rental reimbursement to mitigate downtime. If you operate across state lines or haul specific materials, verify coverage endorsements (e.g., environmental spill limits for certain loads). Premiums scale with driver records, garaging ZIP, and truck value. Ask the carrier about requirements for photographs, VIN verification, and any inspections prior to binding—repo purchases can trigger extra scrutiny.

Title and lien work is critical. A proper lien release from the foreclosing lender and a clean title in the selling entity’s name are non‑negotiable. Verify serial numbers match across the title, cab tag, frame stamp, and any documentation. Check for outstanding UCC filings that could cloud ownership. Clarify odometer/hour statements and disclosures; while heavy equipment often records hours rather than miles, accuracy still matters for valuation and future resale.

Regulatory fit often decides whether a “deal” is truly a deal. Emissions rules differ by region, and some projects mandate certain engine certifications or retrofit devices. Confirm the truck can be registered where you plan to operate and that it meets the requirements of your clients’ job sites. If you haul into restricted zones, calculate the cost of potential upgrades or choose a unit that already complies. Skipping this step can turn a bargain into a stranded asset.

Negotiation Tactics, Red Flags, and Practical Scenarios That Save Money

Smart buyers treat repo opportunities like a structured project: gather data, test assumptions, and move with a plan. Start by assembling market comparables from multiple sources—dealer listings, private classifieds, and recent auction results. Adjust comps for axle count, body material, hoist capacity, transmission type, hours, and region. Use a worksheet to track your ceiling price and an all‑in estimate that includes fees, transport, immediate safety fixes, and a contingency reserve. Enter the auction or negotiation ready to walk away if the economics slip.

Red flags that deserve pause include:

– Fresh undercoating over heavy scale on frame rails.

– Inconsistent hour meter readings versus cab wear.

– Hydraulic cylinders with pitting near the seal sweep.

– Signs of chronic overloading: cracked spring perches, deformed body sills, or fatigued hinge pins.

– Persistent aftertreatment warning lights or evidence of tampering.

Consider two simplified scenarios. Scenario A: You win a mid‑cycle tandem for a modest discount. Buyer’s premium and tax add a few thousand. Two steer tires and four drives plus a complete brake service elevate the out‑the‑door total. However, clean oil analysis and a tight hydraulic system reduce risk, and the truck enters service quickly—your effective discount persists because uptime is strong. Scenario B: You secure a deeper discount on an older tri‑axle, but after delivery you find hoist drift under load, uneven compression, and a weak clutch. By the time you address these items and replace a cracked body brace, the total spend rivals open‑market options, and downtime erodes the advantage.

Quantify productivity to keep decisions grounded. Map expected loads per day, average haul distance, and cycle times; combine with fuel burn, driver wage, and maintenance set‑asides to estimate cost per ton moved. A seemingly pricier, well‑maintained unit can outperform a “cheap” alternative if it completes more cycles with fewer breakdowns. Negotiation is not only about price; it’s about securing dependable capacity at a cost that fits your pipeline.

Conclusion: Turn Discount Iron into Dependable Capacity

For contractors, owner‑operators, and fleet managers, bank‑repossessed dump trucks can be a practical way to add capacity without overextending capital. The winners approach each opportunity with a full‑cost mindset: disciplined inspections, fee awareness, financing and insurance lined up, and paperwork verified before funds move. If you model the entire ownership arc—not just the bid—you’ll spot true value, sidestep avoidable repairs, and put a hard‑working truck on your jobs that pays its way from day one.